As we could not get public dataset for Risky Loan, we have created synthetic data of 1,00,000 personal loan application dataset with columns Applicant ID, Loan Amount, Tenure, Birth Date, Age in Years, Net Take Home Pay, Home EMI, Other EMI, Credit Card Due, Total EMI and Due (Amount) and Net Salary

The data set contains 1,00,000 rows (applicants) and 11 columns. All the applicants are salaried and has made application for personal loan.

Can we detect risky loan applicants from any type of loan data??

Yes, we can detect risky loan applicants from any type of loan provided the required data are available. However, please note that we may have to feature engineering to improve the overall risky loan detection rate.

Result: Top 1,000 Risky Applicants

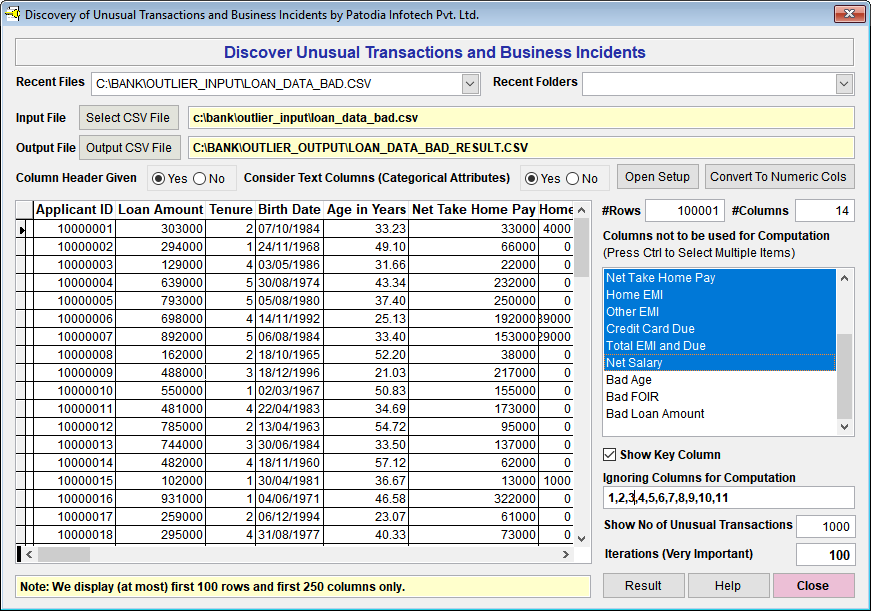

We have selected the dataset in "Discover" and asked to find out top 1,000 risky loan applicants. For this purpose, we have created the following three additional columns:

(1) Bad Age: Complex computation has been used for this.

(2) Bad FOIR ((Fixed Obligations to Income Ratio): Net Take Home Pay / Net Salary

(3) Bad Loan Amount: Loan Amount / Net Salary

We have used the above three columns to compute top 1,000 risky loan applicants.

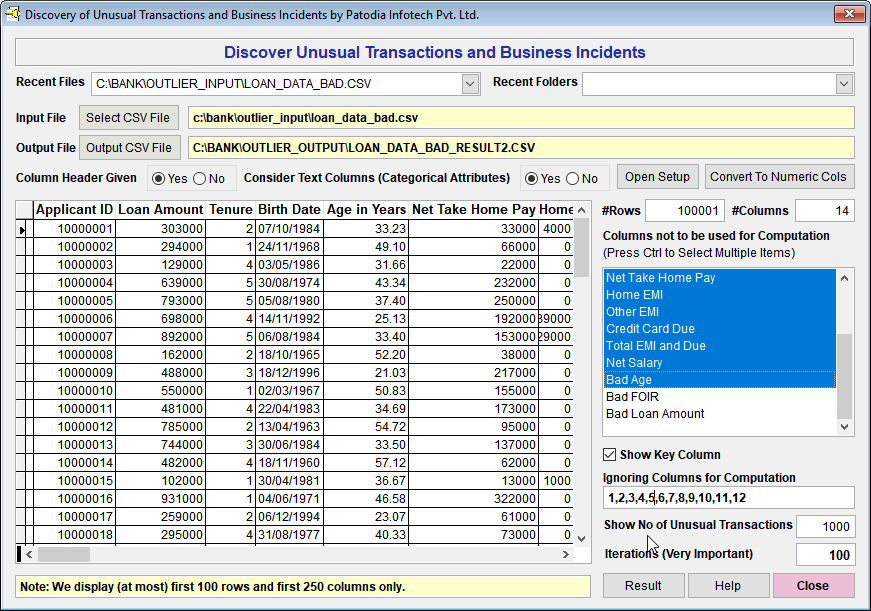

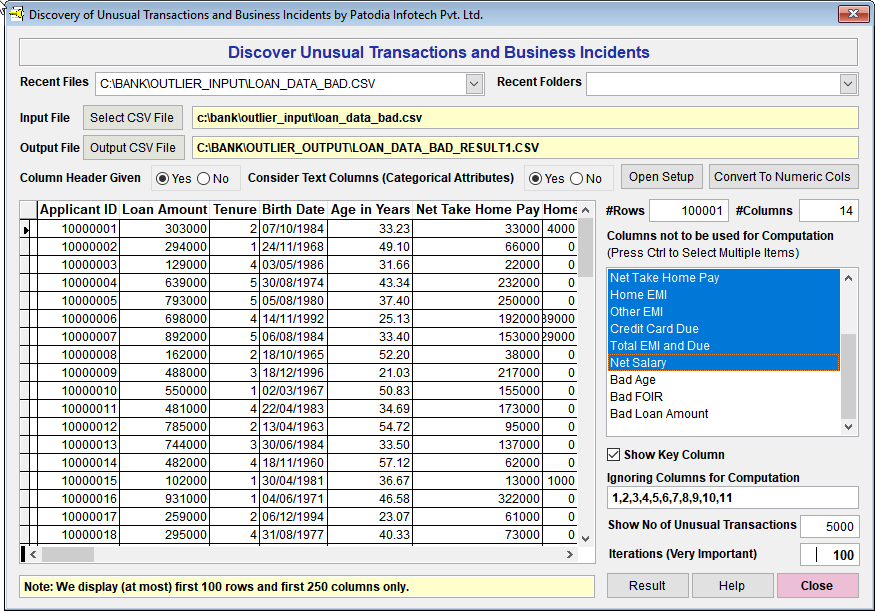

Below, we give the screenshot of "Discover":

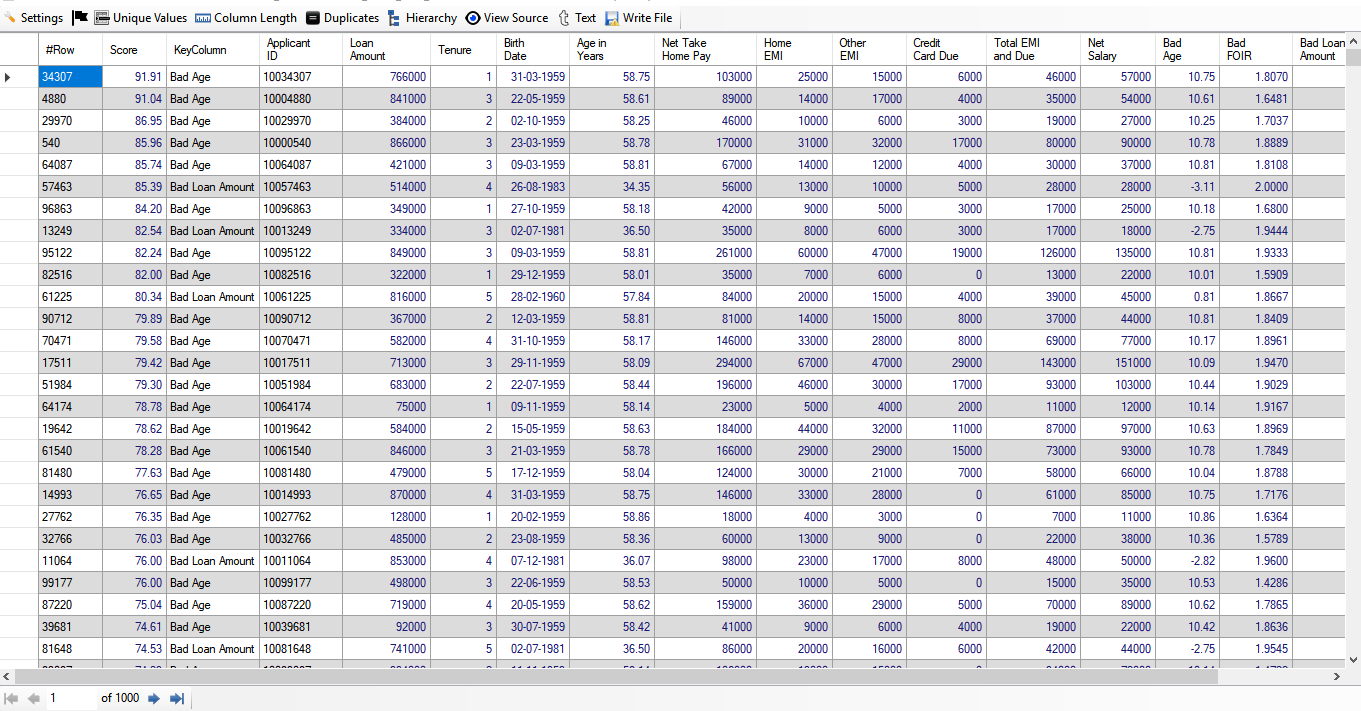

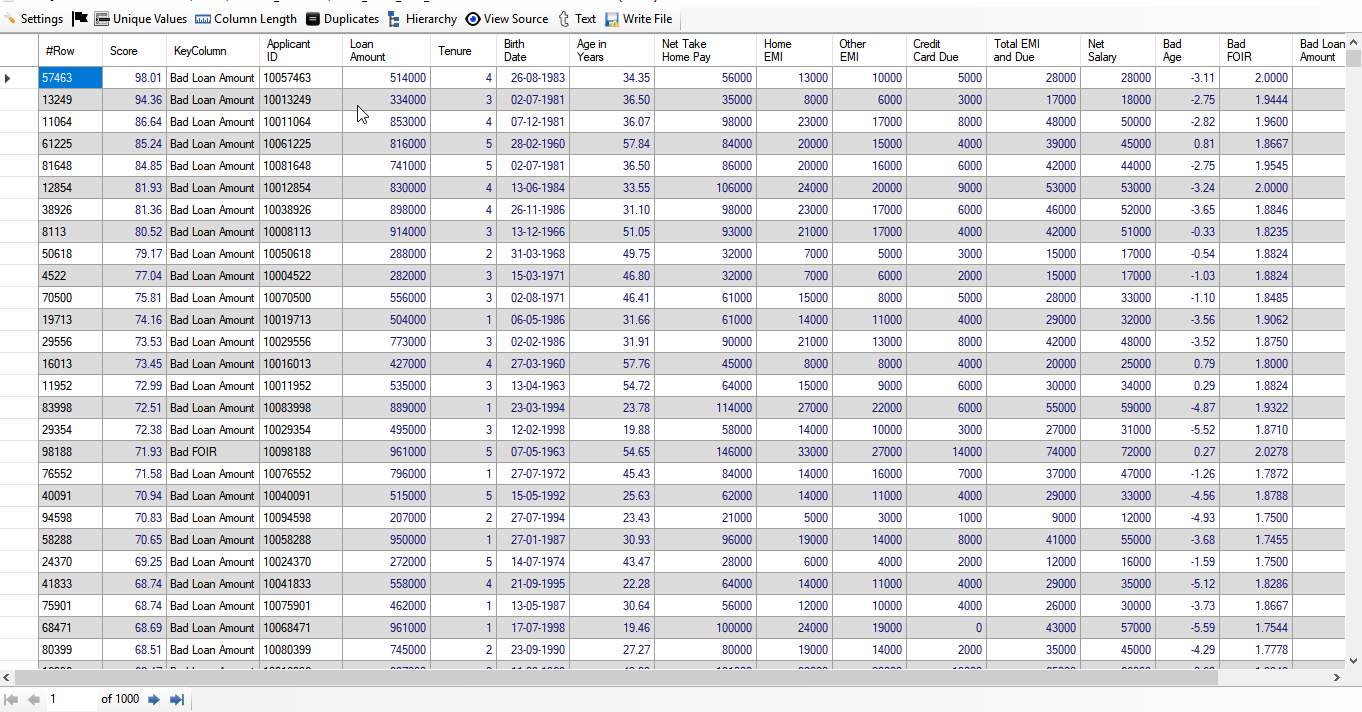

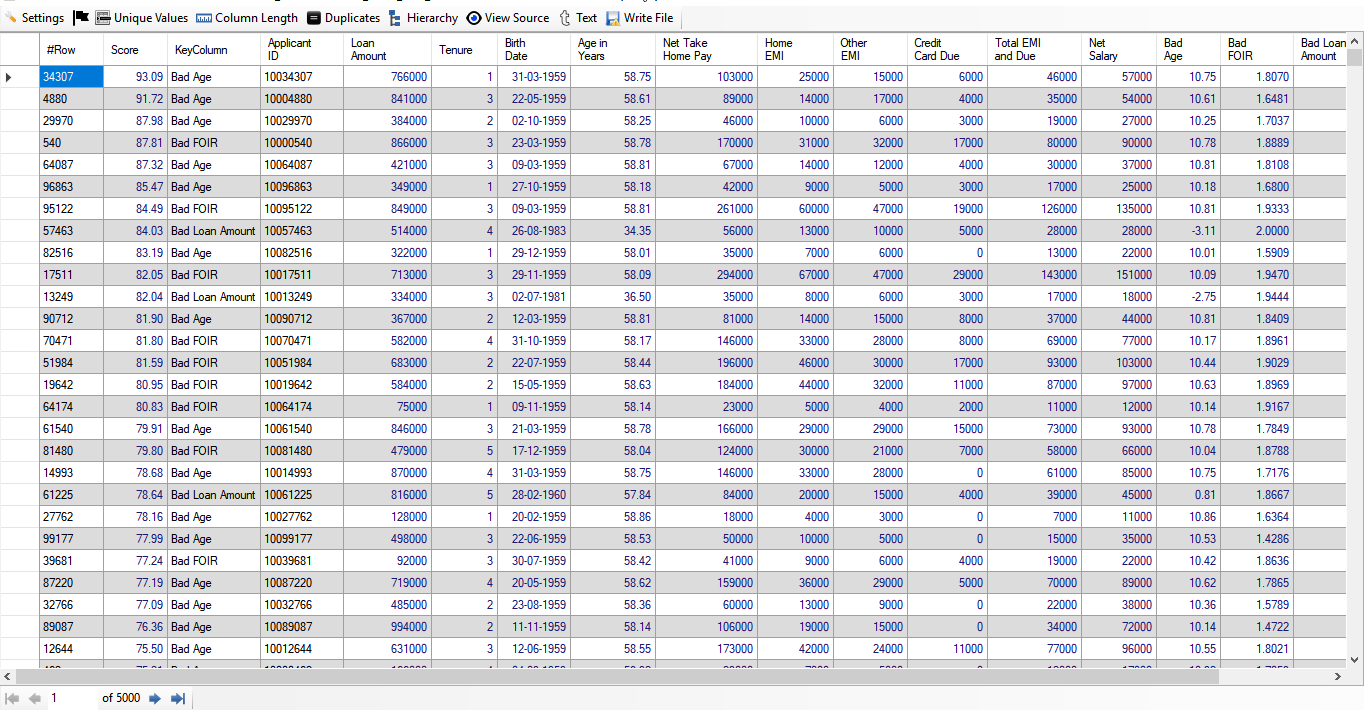

When we click on "Result" button, we see the following result (given screenshot of Result):

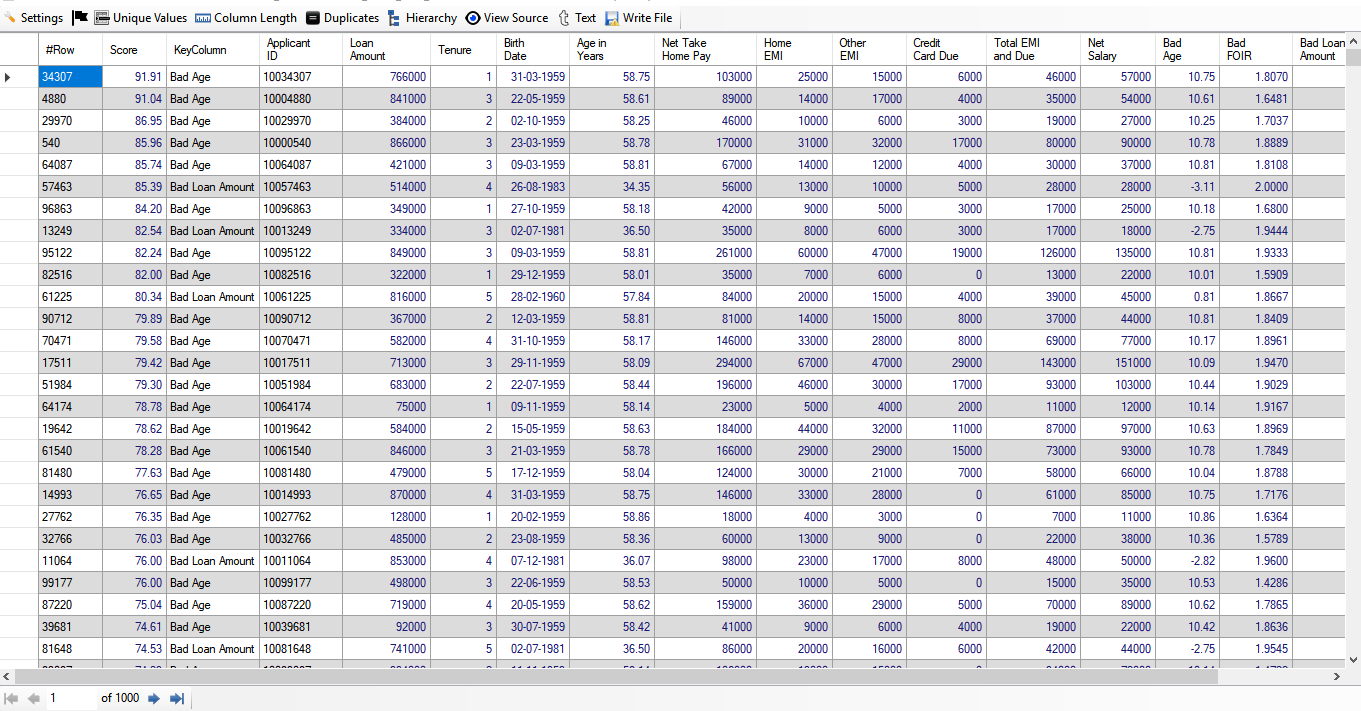

Let us analyse the few applicants starting from the top. The first applicant is having risk score of 91.91%. His age was 58.75 years on the date of application. Assuming, he is retiring at the age of 60, he left 1.25 years or 15 months to repay the loan. He has applied for loan of ₹ 7,66,000. Based on 12% interest rate, his monthly instalment will be ₹ 63,130. His net salary after making payment of all dues is ₹ 57,000. Obviously, the bank cannot grant such loan.

Let us take the sixth applicant from the top. The applicant ID is 10057463. His risk score is 85.39%. His net take home pay is ₹ 56,000. However, his net salary after making payment of instalments and credit card due is ₹ 28,000. First thing to be noted that his FOIR (Fixed Obligations to Income Ratio) is already 50% that is very high. If we assume that loan of ₹ 5,14,000 to be repaid in 5 years and interest rate is 12%, then monthly instalment will be ₹ 11,434. So, the net salary will be ₹ 16,566. How can a person manage his monthly expenditure in ₹ 16,566? The second question is FOIR will be around 70% whereas it should be less than 40%.

So, "Discover" not only finds the risky customers in less than 5 seconds out of 1,00,000 applicants, it provides risk score in percent and then sort these in order of risk score.

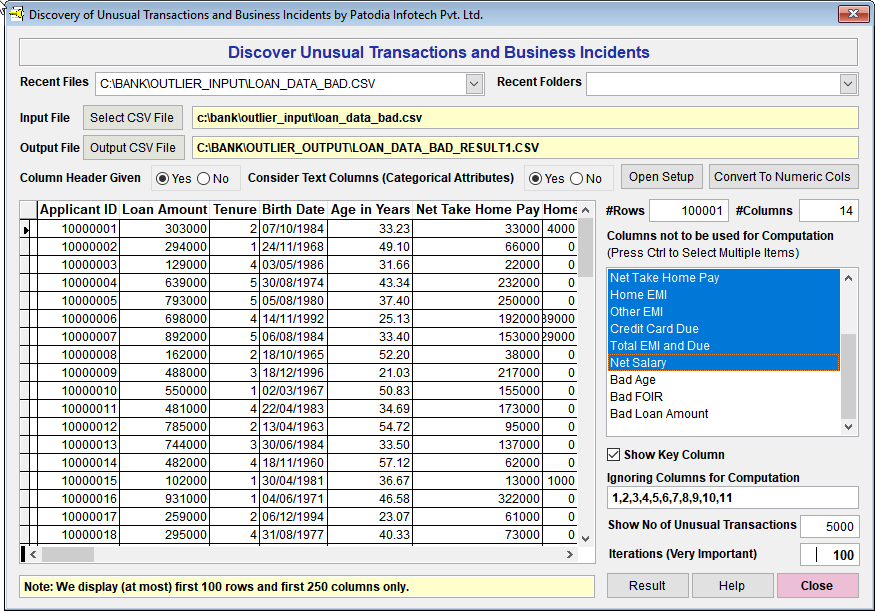

Result 2: Top 5,000 Risky Applicants

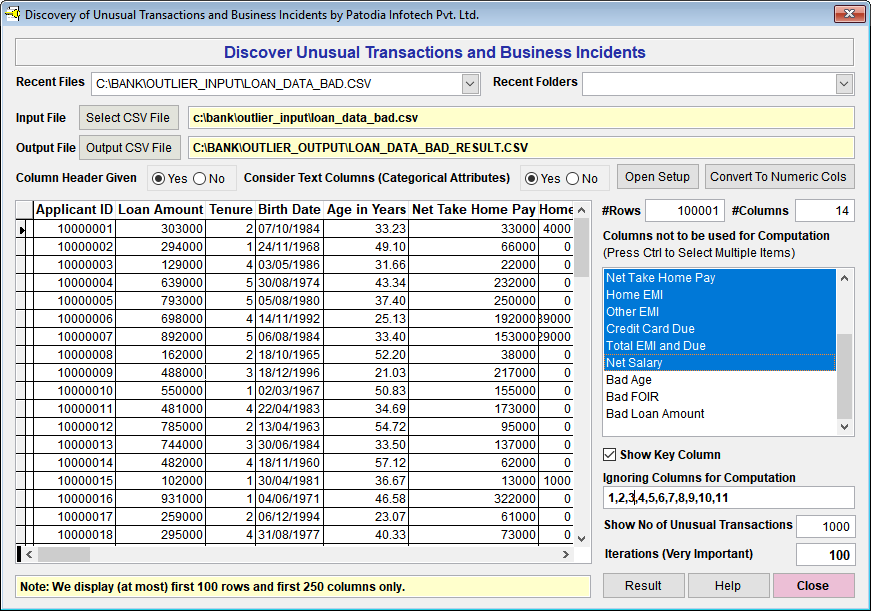

Next, we have selected 5,000 so that we can get list of top 5,000 risky loan applicants. Below, we give the screenshot of "Discover":

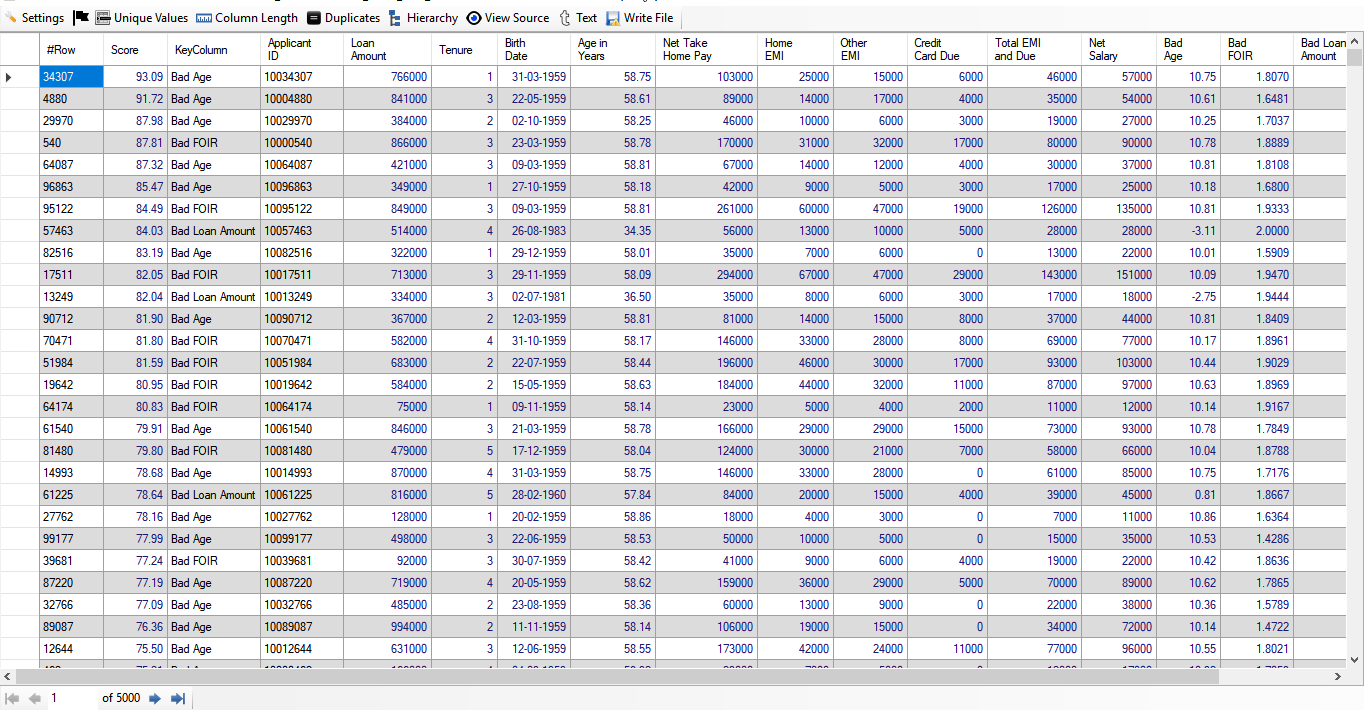

When we click on "Result" button, we see the following result (given screenshot of Result):

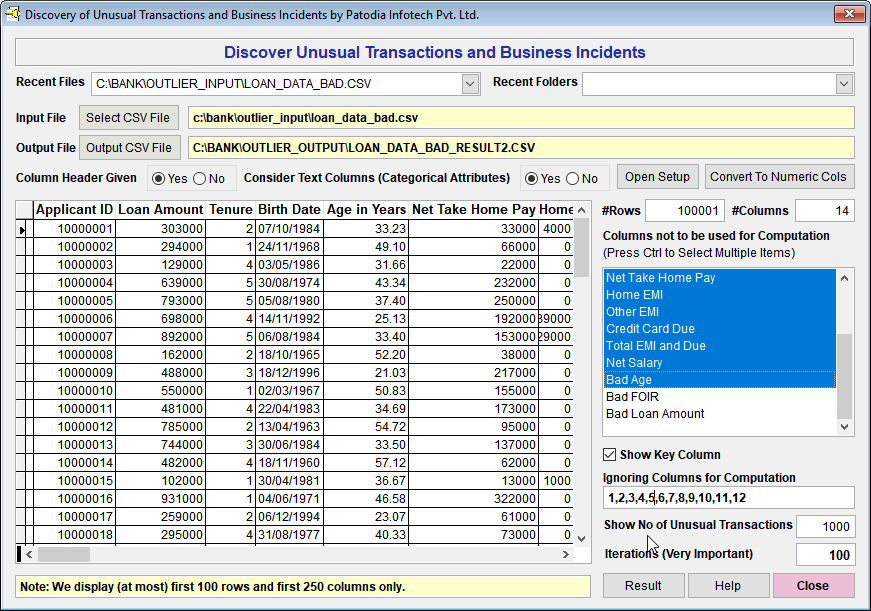

Result 3: Top 1,000 Risky Applicants Based on FOIR and "Loan Amount"

We have selected the dataset in "Discover" and asked to find out top 1,000 risky loan applicants. However, this time, we have ignore the age and considered only FOIR and "Loan Amount".

Below, we give the screenshot of "Discover":

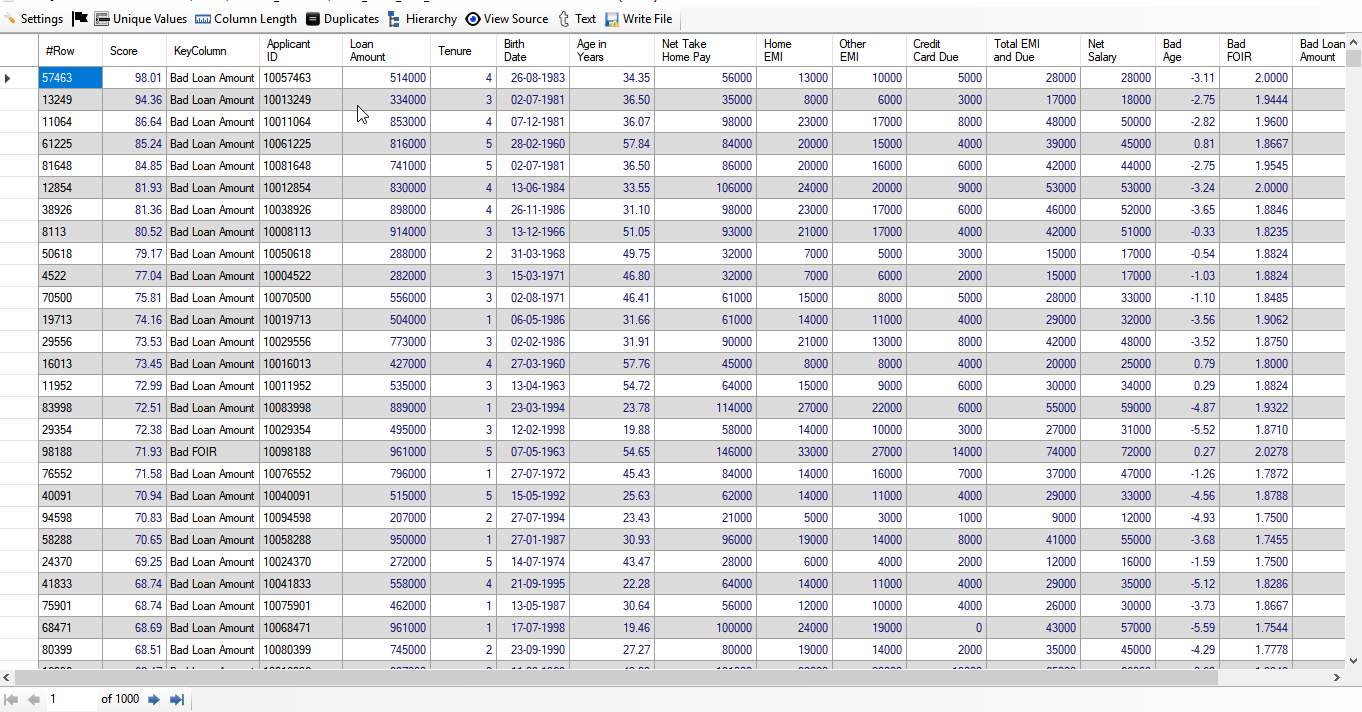

When we click on "Result" button, we see the following result (given screenshot of Result):

Time Taken

Time Taken: It hardly takes 4 to 5 seconds to get list of top 1,000 or top 5,000 Risky Loan Applicants out of 1,00,000 applicants on a moderate hardware.

Important Note: The computation of risky loan applicants is done on the basis of all three factors: Age, FOIR and Loan Amount except in Result 3 wherein we have considered FOIR and Loan Amount only. Key Column just indicated the most important factor and it does not meant that this was the only factor considered.

Can we detect risky loan applicants from any type of loan data??

Yes, we can detect risky loan applicants from any type of loan (like Car Loan, Two-wheeler Loan, Home Loan etc.) provided the required data are available. However, please note that we may have to feature engineering to improve the overall risky loan detection rate.

Can we detect risky loan applicants from any type of loan data??

Yes, we can detect risky loan applicants from any type of loan (like Car Loan, Two-wheeler Loan, Home Loan etc.) provided the required data are available. However, please note that we may have to feature engineering to improve the overall risky loan detection rate.