Non-Performing Assets (NPA) is most serious problem faced by the Indian Banking Sector. As of March 31, 2018, provisional estimates suggest that the total volume of gross NPAs in the economy stands at Rs 10.35 lakh crore. About 85% of these NPAs are from loans and advances of public sector banks. In this scenario, there is urgent need of a solution that can detect the NPA at early stage, so that banks can take effective steps to curb it.

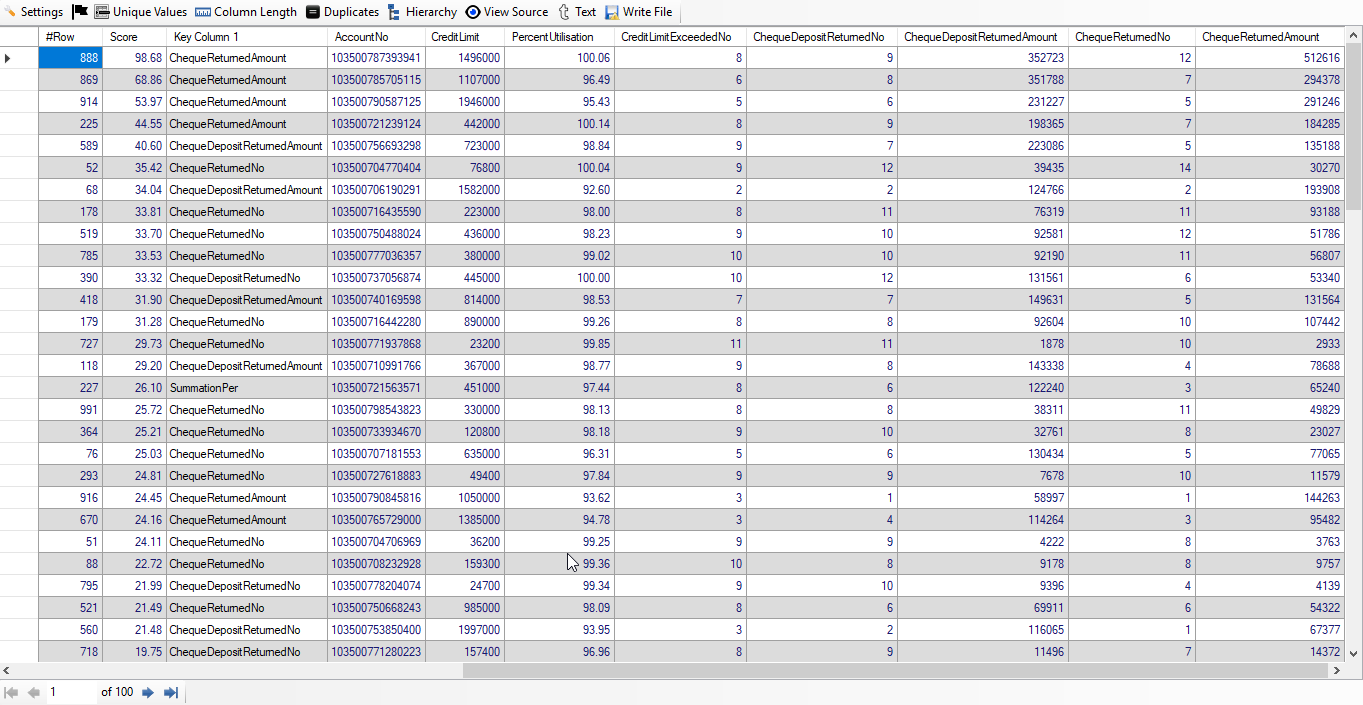

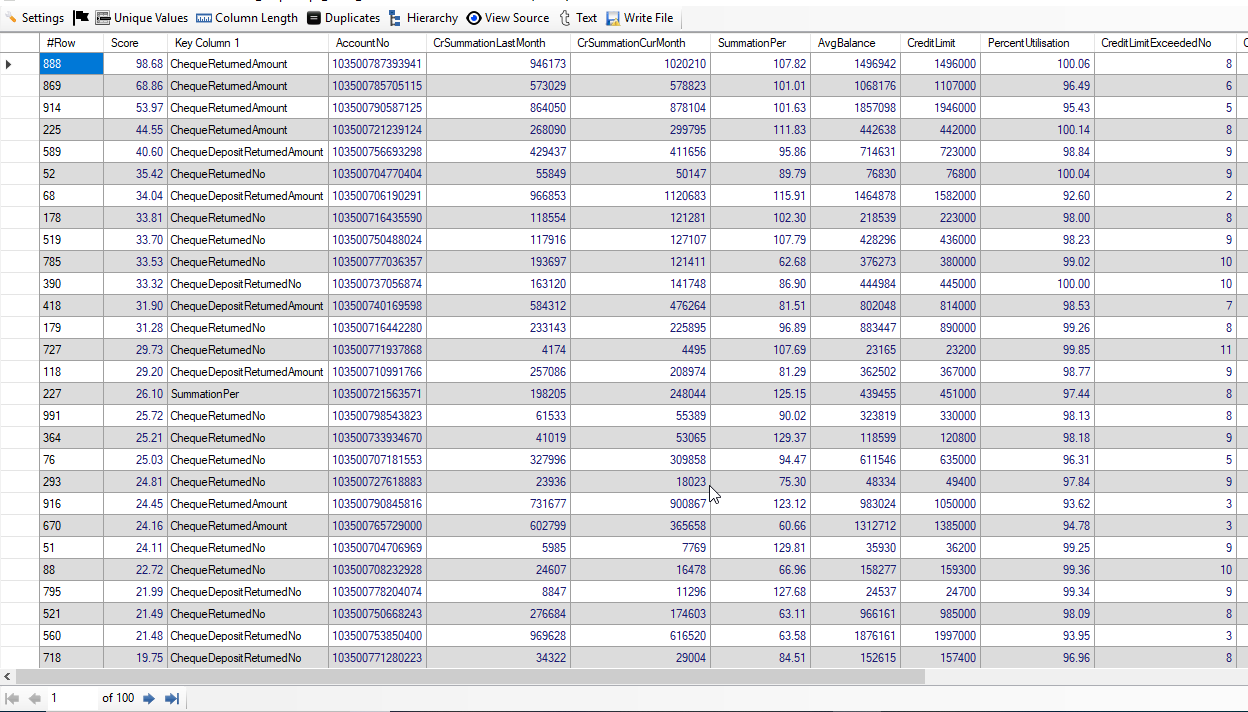

As we could not get public dataset for NPA, we have created synthetic data of 1,000 cash credit accounts with the following columns:

(1) AccountNo

(2) CrSummationLastMonth: Credit Summation of Last Month

(3) CrSummationCurMonth: Credit Summation of Current Month

(4) SummationPer: Percent of Credit Summation using formula: Column3 * 100 / Column2

(5) AvgBalance: Average Balance in the Current Month (All the amount are debit amount. Account with Credit Balance are excluded)

(6) CreditLimit: Credit Limit of Account Holder

(7) PercentUtilisation: Percent Utilization of Credit Limit computed using formula: Column5 * 100 / Column6

(8) CreditLimitExceededNo: Number of times credit limit exceeded in the Current Month

(9) ChequeDepositReturnedNo: Number of Cheques Returned (Deposited by the Account Holder). The account holder is payee.

(10) ChequeDepositReturnedAmount: Total Amount of Cheques Returned (Deposited by the Account Holder)

(11) ChequeReturnedNo: Number of Cheques Returned (Presented for debit to the Account). The account holder is drawer. This includes online debit received in the account and transaction was not successful because of insufficient balance or some other rasons.

(12) ChequeReturnedAmount: Amount of Cheques Returned (Presented for debit to the Account).

The data set contains 1,000 rows (Number of Cash Credit Accounts in a Branch) and 12 columns.

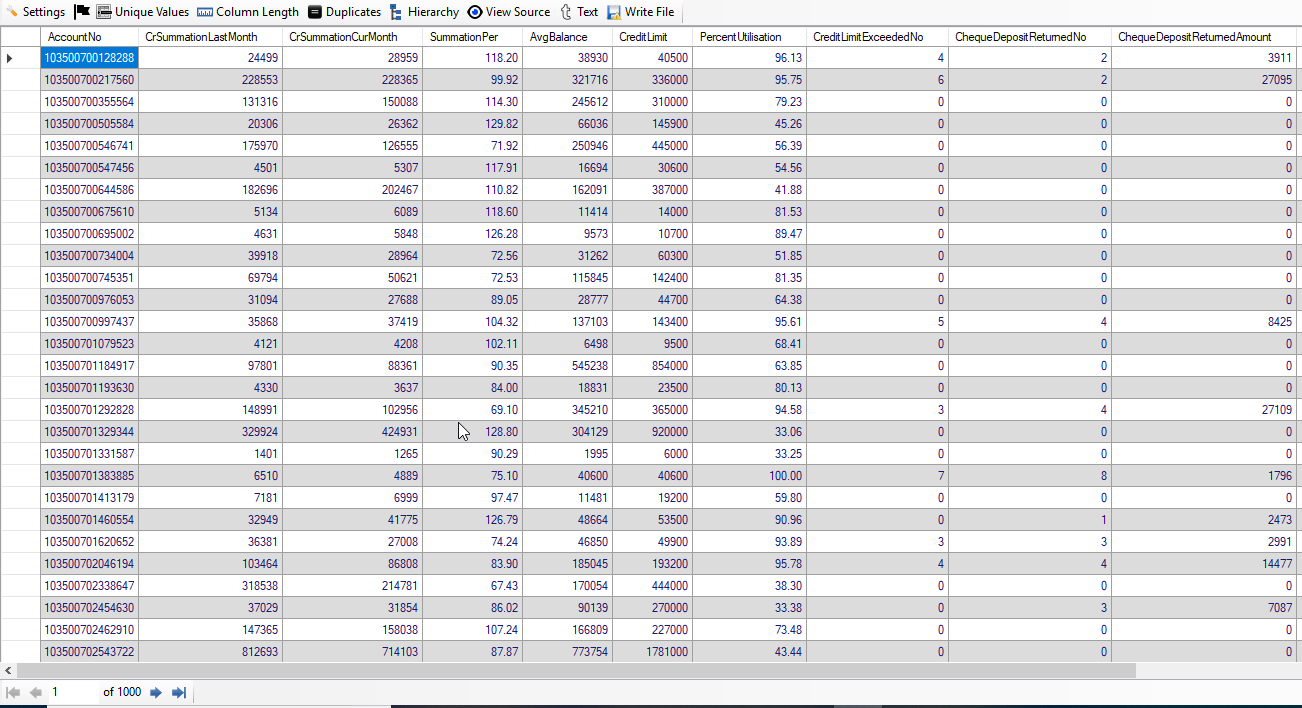

Below, we give the screenshot of Cash Credit Accounts Data Displayed (Part 1) wherin first 10 columns are displayed:

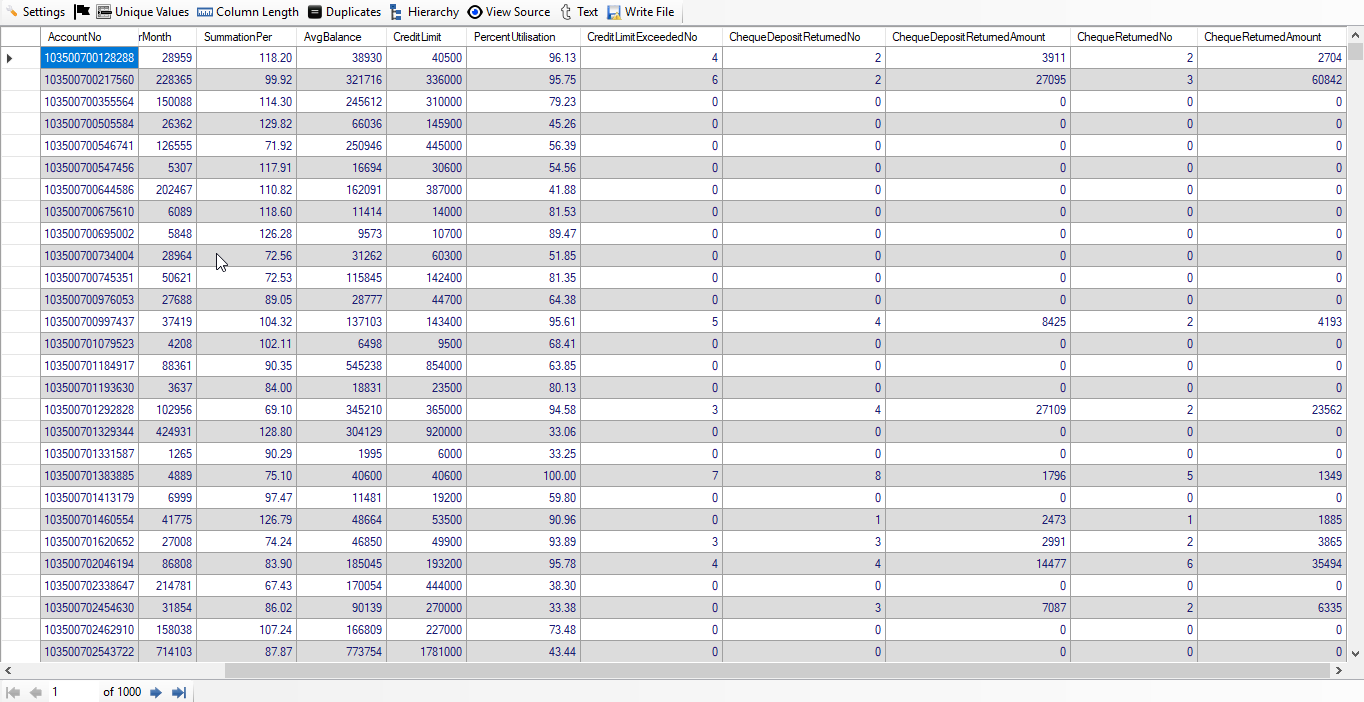

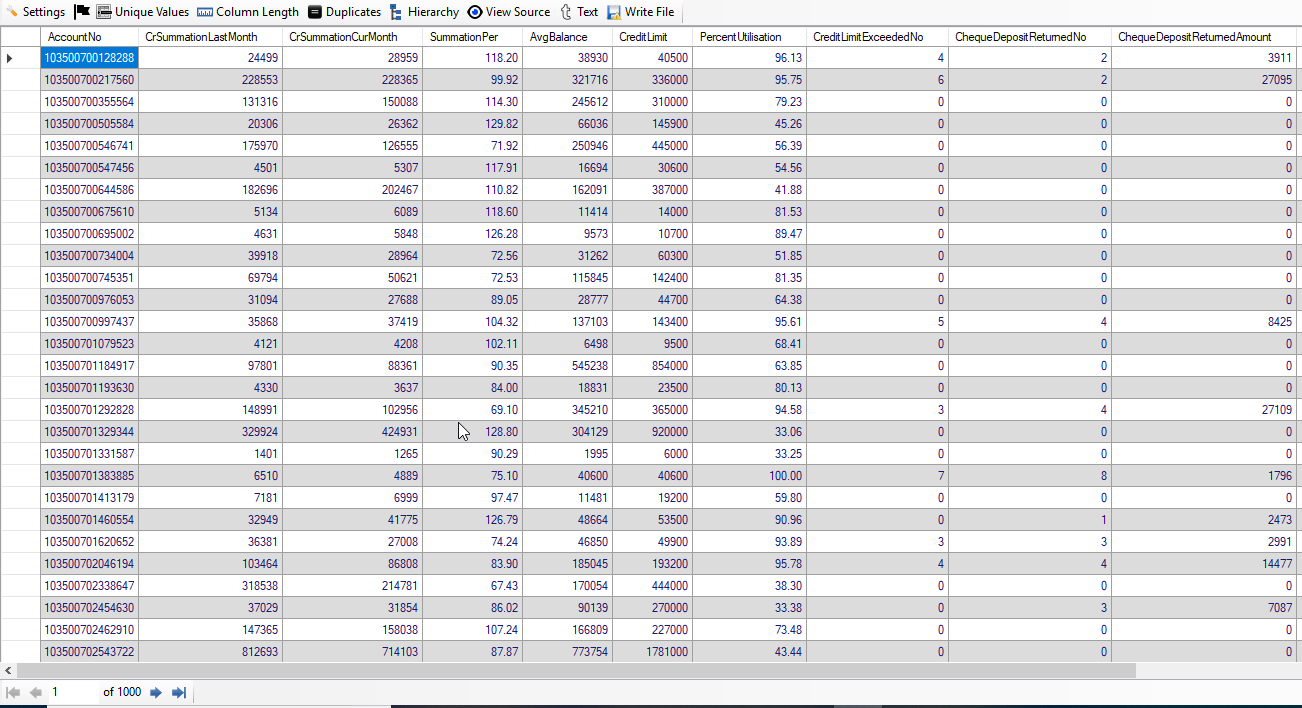

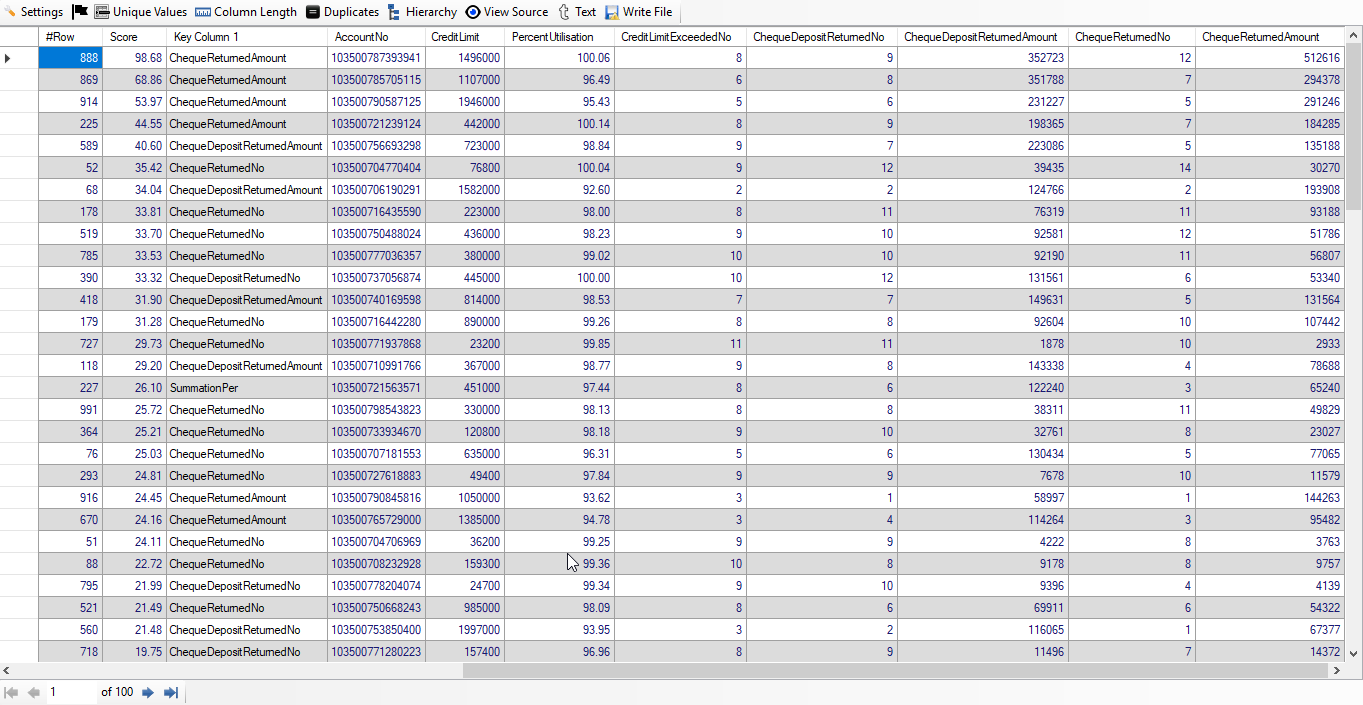

Below, we give the screenshot of Cash Credit Accounts Data Displayed (Part 2) wherin rest of the columns are displayed (Just check the first column and last 2 columns):

Can "Discover" detect likely NPA at early from any type of loan data?

Can "Discover" detect likely NPA at early from any type of loan data??

Yes, "Discover" can detect likely NPA from any type of loan/account provided the required data are available. However, please note that we may have to do feature engineering to improve the overall risky loan detection rate.

Result: Top 100 Accounts likely to become NPA

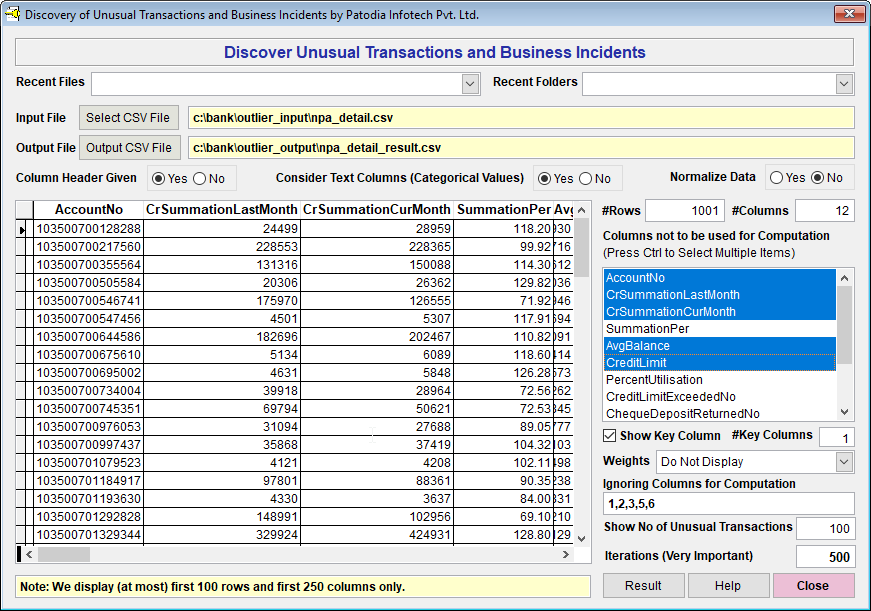

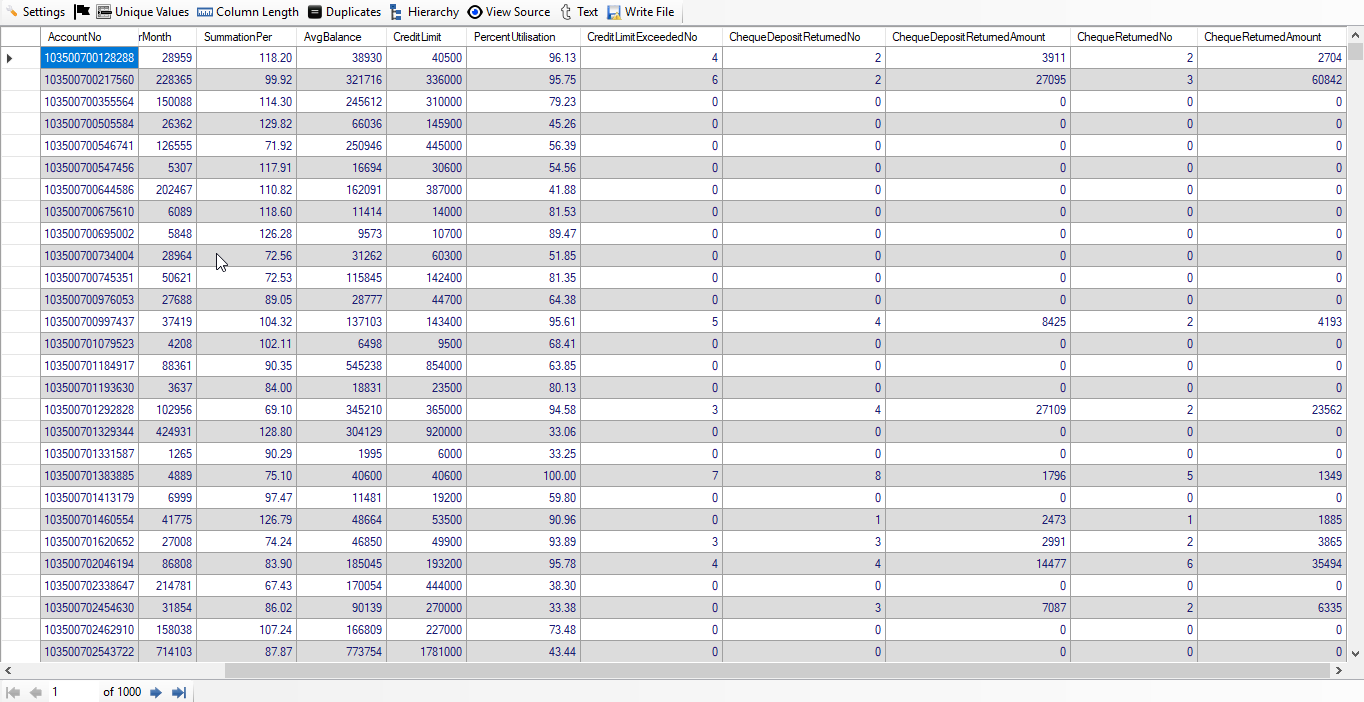

We have selected the dataset in "Discover" and asked to find out top 100 risky accounts.

We have used the following columns (marked with two **) to compute top 100 risky accounts (Likely to become NPA):

(1) AccountNo

(2) CrSummationLastMonth: Credit Summation of Last Month

(3) CrSummationCurMonth: Credit Summation of Current Month

**(4) SummationPer: Percent of Credit Summation using formula: Column3 * 100 / Column2

(5) AvgBalance: Average Balance in the Current Month (All the amount are debit amount. Account with Credit Balance are excluded)

(6) CreditLimit: Credit Limit of Account Holder

**(7) PercentUtilisation: Percent Utilization of Credit Limit computed using formula: Column5 * 100 / Column6

**(8) CreditLimitExceededNo: Number of times credit limit exceeded in the Current Month

**(9) ChequeDepositReturnedNo: Number of Cheques Returned (Deposited by the Account Holder). The account holder is payee.

**(10) ChequeDepositReturnedAmount: Total Amount of Cheques Returned (Deposited by the Account Holder)

**(11) ChequeReturnedNo: Number of Cheques Returned (Presented for debit to the Account). The account holder is drawer. This includes online debit received in the account and transaction was not successful because of insufficient balance or some other rasons.

**(12) ChequeReturnedAmount: Amount of Cheques Returned (Presented for debit to the Account).

Please note that we have ignored 1,2,3,5,6 columns to compute likely NPA Accounts.

Below, we give the screenshot of "Discover":

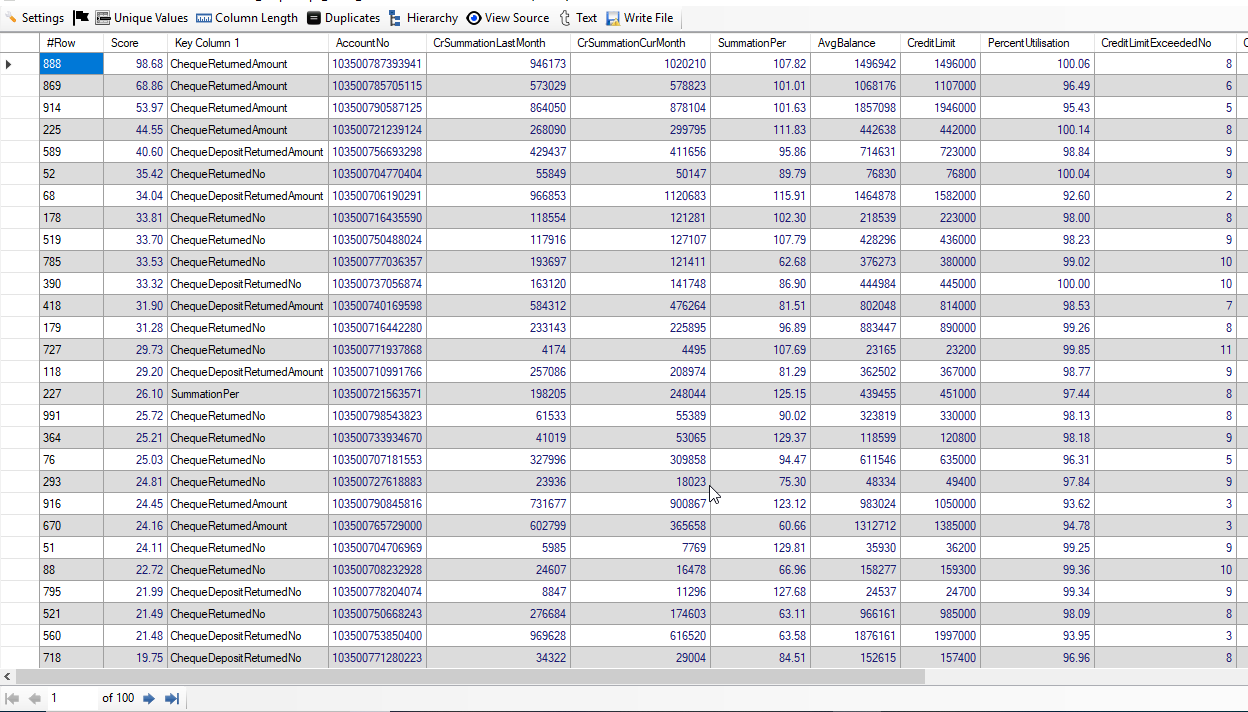

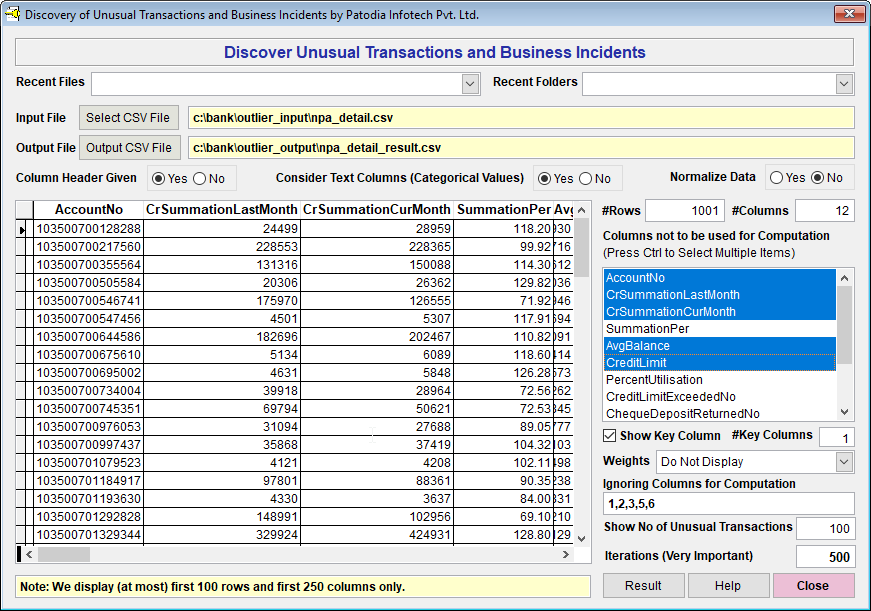

When we click on "Result" button, we see the following result (given screenshot of Result):

As we are not able to see all the columns, we are displaying part 2 of the result so that you can see the rest of the columns (Please see last 4 columns as rest of the colums are repeated):

Let us analyse the first account. First Account Number is 103500787393941 and its NPA Score is 98.68%. Below, we provide detailed analysis of this account:

(1) The Credit Summation of last month was ₹ 9,46,173 and of current month is ₹ 10,20,210. As the Credit Summation has increased by 7.82%, it is good sign. So far, nothing wrong.

(2) The Average Debit Balance in the account is ₹ 14,96,942 and the Credit Limit is ₹ 14,96,000. This is the first negative sign. The average balance should be less than the credit limit. Further, it is shown that credit limit was exceeded 8 times in the current month. This clearly shows that the company is probably going through some problems and facing monetary crunch.

(3) It was found that 9 cheques amounting to ₹ 3,52,723 were returned unpaid (deposited by the account holder as payee). Probably, these were cheques of associate companies and were issued in favour of the account holder just to avoid the status of NPA. This is the second warning signal.

(4) There were 12 cheques amounting to ₹ 5,12,616 returned from the account. This is probably the most serious of all. Probably, these cheques were returned because the account was already overdrawn and there was no balance to pass these cheques. Cheques returned from the account has very bad impact on its credibility and it also attracts penalty under Section 138 of the Negotiable Instrument Act. Under this section, the account holder can be punished with imprisonment for a term which may be extended to two years, or with fine which may extend to twice the amount of the cheque, or with both.

In similar fashion, the Bank can analyse the top 20 accounts and take necessary steps.

So, "Discover" not only finds the Likely NPA accounts in less than 1 second out of 1,000 cash credit accounts, it provides NPA score in percent and then sort these in order of NPA score.

Can "Discover" detect likely NPA at early from any type of loan data??

Yes, "Discover" can detect likely NPA from any type of loan/account provided the required data are available. However, please note that we may have to feature engineering to improve the overall risky loan detection rate.